We create time and transparency for you:

Administration of your assets

We relieve you by taking over administrative tasks for you. This includes – optionally – the following activities:

- Digitisation of your contracts and other important documents with an authorisation concept

- Sifting and digital distribution of your mail

- Digital invoice verification and approval depending on the authorisation of the individual family members, various employees and administrators as well as the family office.

- Takeover of payment transactions after payment release by the 4-eyes principle.

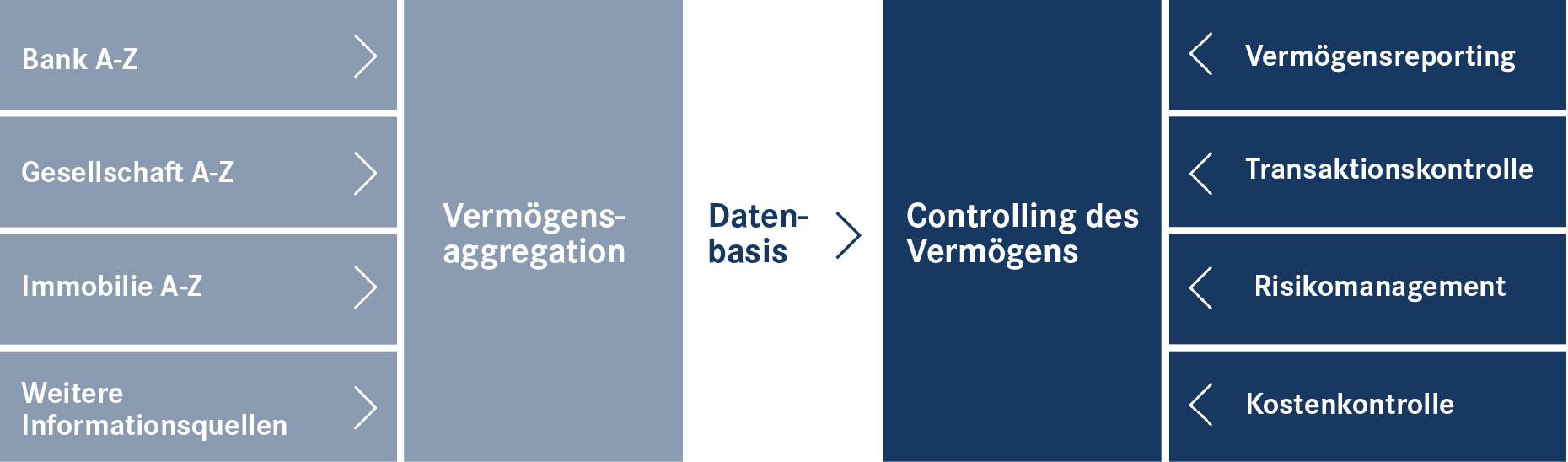

Asset-aggregation, -controlling and -reporting

Everything here revolves around figures, data and facts: Using state-of-the-art technology, we provide you with an overview of your assets that can be called up at any time to show the risks and potential for changes in your assets. In this way, decisions that are already taken can be adjusted and planned decisions can be weighed up and prepared.

The reporting evaluations are presented by us at the intervals of your choice and are addressed to your family and – if desired – to your advisors and/or external asset managers.

You can set individual transparency priorities:

-amount of assets, investment structure, financing, ratios

-profitability, performance, risk

-cashflow considerations, review of withdrawal capacity

-consolidation in the event of information overload

-recognizing information deficits and gaps

-cost control of banks, external consultants and administrators

-tax documentation for tax assessment and for future audits by the tax office -overview of deposits and withdrawals by family members

Support in the selection of asset and property managers

If required, we can introduce you to alternative, reputable asset managers depending on your investment priorities. We can recommend special mandates, e.g. only for European bonds or only for American equities, taking into account your risk management and sustainable investment requirements.

Depending on the real estate segment, we can put you in touch with various property managers with the relevant expertise, as residential real estate requires a different approach than commercial or mixed-use property.

Property management

We are happy to support you with the following property management services:

-payments: Checking incoming invoices including the approval process

-checking incoming rent payments and the associated dunning process

-coordination of legal advice relating to your properties

-coordination of rental and loan agreements including term management

-assistance in selecting a property management company or a suitable real estate agent

-yield and sensitivity calculations for your properties

-investment calculations and planning for existing properties

-regional and sectoral risk assessment

Support with tax and legal issues

Following our joint consultation, we coordinate your internal and external advisors on your various asset and loan commitments and ensure that your various advisors work together smoothly on the issues you have defined. We then report to you on this and prepare decision papers for you.

In cooperation with your personal tax and legal advisors, we develop tailor-made solutions for your problems and, if necessary, offer you the services of other tax and legal experts.

Insurance management

We would be happy to catalog your current insurance solutions and then have them reviewed by an independent party to identify any potential for optimization or savings. This applies to both personal and property insurance.

Entrepreneurial investments, private equity, venture capital

In addition to receiving and digitally storing your correspondence, we summarize the results of your investments in a semi-annual report, inform you of any anomalies on an ongoing basis and ensure that your foreign investments in particular are taxed correctly. As a special asset class, private equity investments and venture capital always require special attention. This begins with the identification of suitable investments, in which we are happy to support you if required, through to close ongoing controlling and the proper handling of the exit.

Emergency planning

In the event of serious illness or death, your loved ones will not only find the names and telephone numbers of all your contacts such as your lawyer, tax advisor, bank advisor or executor in a folder that is always to hand, but also all the information on your accounts, securities accounts, properties, company investments, art, jewelry, hunting weapons, patents, rights, licenses, insurance policies and safe deposit boxes in one place.

We also store information on club memberships to be terminated, newspaper subscriptions, the continued care of your pets, passwords for your digital estate and even information on the storage of your will and who should or should not be invited to the funeral service.

We offer this service not only as part of the Family Office, but also as a fee-based service for other wealthy private individuals.

Art consulting

Our law firm has many years of special expertise in providing tax and legal advice to artists of various genres, art collectors and gallery owners.

In addition, the Ganteführer Family Office has a broad network of artists, galleries and auction houses and can advise you on the furnishing of private and commercial premises, help you with insurance and valuation as well as the discreet purchase and sale of artworks.

In cooperation with a professional partner, we can also assist you with art as an asset class and offer you exclusive access to diversified art portfolios. Based on an expert- and data-based process, our partner selects suitable works of art and represents them via a fully regulated security or a direct investment. Custody and subsequent sale are also fully covered by our partner. The artworks are sometimes exhibited and can be viewed at exclusive events.

Company sales / M&A

Are you planning to sell your company? Then you should look for the right partners at an early stage, who may accompany you in this process for several years.

We have a qualified network ranging from M&A boutiques specializing in specific sectors to internationally active banking arms.

Important: If you wish, we can be at your side as an independent family office throughout the entire, sometimes emotional, process and accompany you from the selection of possible M&A advisors and specialized tax consultants to the investment of the sale proceeds.

Organization of the family – family governance

If you wish, we can provide you with independent support on the way to a good and conflict-free family climate. We involve inexperienced family members and support you in developing shared family values and rules as well as structures for managing (family) assets and the company. In cases of conflict, a mediation process can be useful. You can find out more here.

Supporting the generational transition

Asset owners should think about their succession at an early stage and carefully plan the management and asset succession. All family members, with their different goals and interests, should be involved in this process. A succession process must be planned so that the transferring and subsequent generations can make qualified decisions. The Family Office also supports and accompanies you in this process. In this way, emotional obstacles can often be overcome in the best possible way. With the help of specialists, even complex constellations can be led to a succession plan that is suitable for all parties involved.

Inheritance advice

Are you overwhelmed, for example, by the task of settling your parents’ estate? Are you inexperienced or have no business training? We will provide you with a prompt overview of the assets transferred to you and any liabilities, work with you to settle the estate and tell you what rights and obligations this entails for you.

After creating transparency, we will discuss with you how you can relieve yourself in a targeted manner and to whom you can delegate which administrative tasks.

Experience shows that in such stressful phases, decisions are made too quickly, thoughtlessly or simply wrongly due to a lack of information – we support you professionally and are only committed to you!

Philanthropic, charitable commitment

There are many different facets to charitable commitment: it ranges from individual or regular donations, e.g. for social, scientific or cultural projects, to large donations to a foundation, the establishment of your own foundation or a charitable limited company of the entrepreneurial family. We are happy to support and advise you in defining and implementing your philanthropic goals.

Establishment of a foundation

Regardless of whether you are planning a charitable foundation, a family foundation or a corporate foundation:

Together with your lawyer and tax advisor, we will support you in setting up the right type of foundation for your needs and, if required, will also provide you with qualified lawyers or tax advisors from our network. In our experience, it is particularly important to make the right decisions in this phase of setting the course, also in order to drive forward the often lengthy foundation process (foundation law is state law) in your best interests.

In addition to a fiduciary foundation, the establishment of which is a relatively simple, standardized process, a legally independent foundation should be set up, especially for larger assets, because it can be structured more individually and the running costs can be spread over a larger amount of assets

Foundation support

As soon as your foundation is set up, it begins to “live”: the management of the assets, which is subject to reporting requirements, begins with the first endowment.

We also offer professional management without vested interests for very individually structured foundations with very different asset classes such as properties, company investments, art and jewelry, as we have deliberately decided not to obtain a banking license/Bafin approval and – if you wish – we can advise you freely in the selection of your asset manager(s).

Our tasks include ongoing controlling and risk management of the investment strategy and results as well as the professional preparation of reports for the tax office and the foundation supervisory authority and coordination with foundation committees even after the founder(s) have left the foundation.